An Fha Rehab Home Mortgage Is Perfect For Fixer-uppers

How can I fix my house with no money?

According to the Department of Housing and Urban Development, the maximum FHA lending amount for high-cost metropolitan areas rose to $765,600 for calendar year 2020 (up from $726,525 in 2019). In Drug Detox areas with lower housing costs, the FHA limit can be as low as $331,760. Obviously, there's a broad spectrum in between.

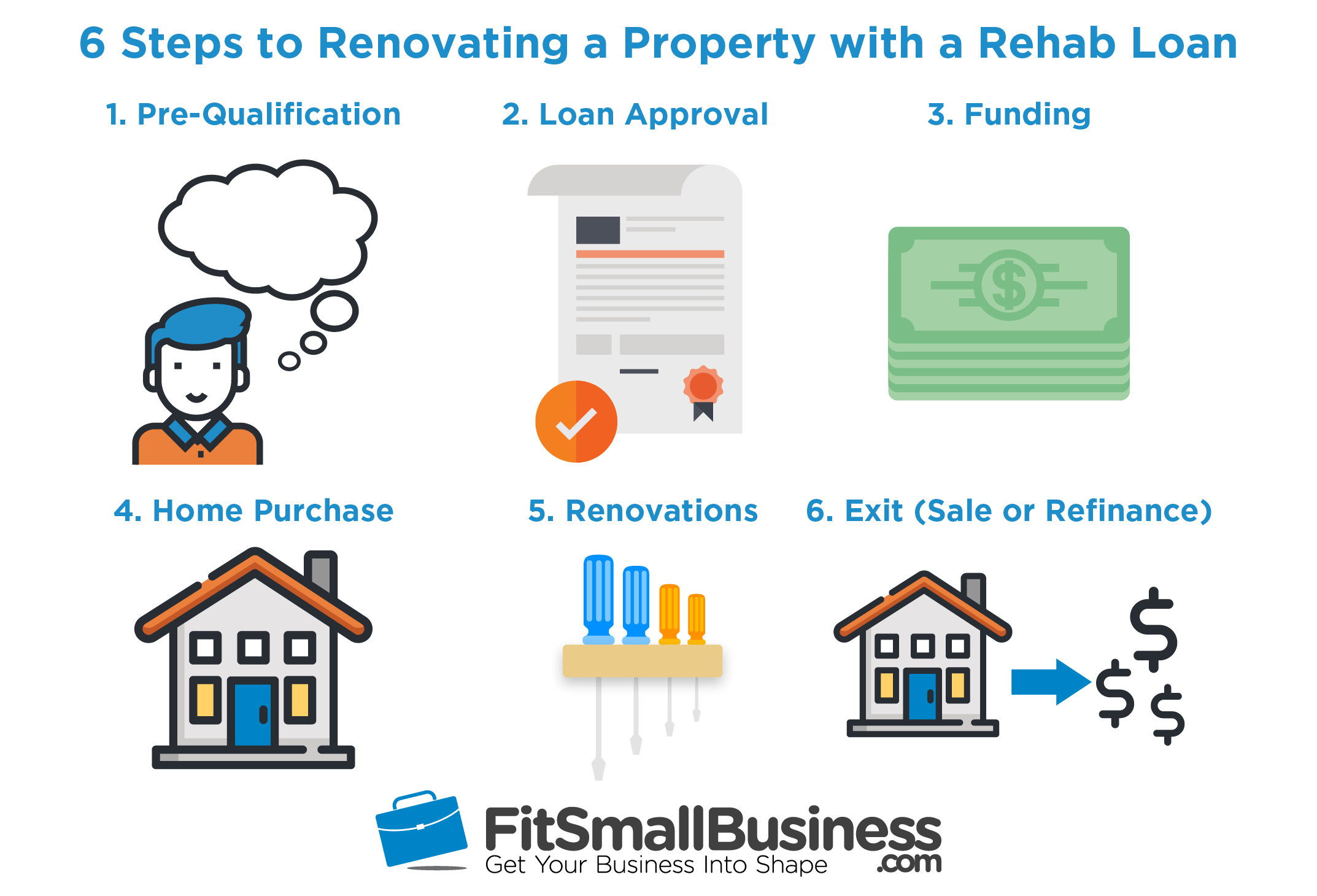

Rehabbing a house takes some time, functioning funding as well as experience; it's not something you intend to leap right into if you're not prepared. Rather, investors are encouraged to mind their due persistance prior to getting going, including evaluating all their options. While rehabbing can bring profitable returns, it's a complicated departure method that should not be ignored. Mortgage Loan Directory Site and Details, LLC or Mortgageloan.com does not offer home loans or financings. Mortgageloan.com is a web site that gives info regarding lendings and home loans and does not use lendings or mortgages straight or indirectly via agents or agents.

A fantastic location to begin is by participating in a realty networking occasion in your area as well as learning more about other property specialists. Several ambitious financiers likewise locate it practical to locate a coach in the industry that can offer guidance on beginning. As you familiarize yourself with the total work involved in a rehab, you can after that begin by searching for perfect homes. It can take anywhere from 6 weeks to 6 months to rehab a house.

Where do I start remodeling my whole house?

Renovation loans open more doors It requires a minimum credit score of 500 with a down payment of at least 10%; a credit score of 580 or higher allows a down payment of 3.5%. These loans can't be used for work that the FHA deems a luxury, such as installing a swimming pool.

In many cases, the only prices connected with these sorts of buttons will be for devices and also materials. Now starts the manual labor of rehabbing your investment. The stage will consist of removing all garbage from within and outdoors of the home, along with harmed products such as doors, windows, fixtures, etc

Have you discovered a residence that you enjoy, yet it remains in bad shape? The 203k car loan may be an excellent means to acquire a Mental Health Facility home that is a little harsh around https://blogfreely.net/merifia630/h2-do-i-need-medical-insurance-to-get-this-solution-h2-teen-use-illegal the edges. Financiers seeking an area to start should evaluate the aesthetic appeal in the surrounding neighborhood and area. Research which sorts of plants succeed in the area, and which types are reasonably reduced upkeep. There is likewise a possibility to make minor adjustments, such as replacing your home numbers or mail box that can make a subtle difference when selling the home.

- Customers end up with one fixed-rate FHA car loan, as well as a house that remains in better form than when they located it.

- The 203k loan assists the consumer open up one lending to pay for the purchase rate of the home, plus the expense of fixings.

- Rehabilitation mortgages are a kind of residence improvement finances that can be utilized to acquire a home looking for job-- one of the most typical of which is the FHA 203( k) loan.

There are numerous elements investors can make use of to identify how much time a task will certainly take consisting of the size of the home, the specific remodelling tasks, as well as your team of workers. To get an extra concrete understanding of a rehab job, look at each of these factors before purchasing a provided residential property. It can likewise be a great idea to research how promptly properties are being marketed in your market, as this will hint at for how long it may take the residential property to offer as soon as the rehabilitation is full.

How do I gut my house myself?

In general, FHA loan rules are designed for borrowers to have one FHA mortgage at a time, and to allow borrowers to refinance an existing mortgage to a new FHA loan. In most cases a borrower cannot have two FHA loans at once, with certain exceptions made for extenuating circumstances.

. The function of the cleaning is to prep the residential or commercial property for improvements, which will certainly permit the rehabbing process to run smoother. Furthermore, this phase can be finished for nothing in cost, as most of job can be finished with your very own sweat equity.

When remodeling a bathroom What do you do first?

FHA 203(k) Rehabilitation mortgages allow first-time homebuyers to take advantage of below-market interest rate loans that cover costs of purchasing and making full or limited renovations to your dream home. This program may also be used to finance abandoned or foreclosed properties.

You can borrow an optimum of $35,000 for repair services with this version. Closing a rehab car loan is a much more difficult job than is shutting a traditional home mortgage. Because the repair that fixer-uppers need is frequently tough to estimate, there is extra that can fail with a rehabilitation funding, she said.

Once all conditions are gotten, the customer signs final financing files. Part of the loan funds are put into an escrow account, which holds the cash for the repair work. If the property you are taking a look at require structural fixings to get approved for financing, you will require to use a complete 203k rather than a Streamline 203k, or find a different residential or commercial property. This makes sense, because, generally houses much less than a years of age do not need substantial recovery.